Fuel Your Business Growth - Discover Our MSME Loans

Grow your business with our easy and flexible MSME loans, designed to support your unique needs and aspirations

Grow your business with our easy and flexible MSME loans, designed to support your unique needs and aspirations

Our MSME Loans are more than money, they help in your Business Growth

Our MSME loans provide you the money that need to help your business grow smoothly. With PHF Leasing, you can confidently fuel your business expansion.

You can pay back the loan in a flexible way and apply with few documentations. We make financing easy, so you can focus on your business.

Borrow at a competitive low interest rate, making it easier to repay your loan. We ensures affordability with low-interest rates adapt to your needs.

Paying back loan on time helps you get more loans in future for your business. At PHF Leasing, we support your financial growth with every loan.

The money helps your business to grow and succeed. Our commitment is to see your business bloom.

Our loans are tailored to meet the specific needs of your business, ensuring you get the support you require.

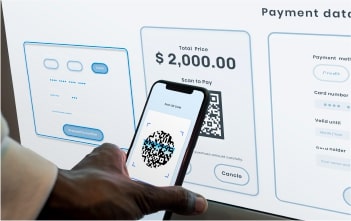

a quick and transparent process

Check eligibility criteria before applying for a loan to ensure approval possibilities.

Estimate your monthly EMI effortlessly with our user-friendly loan calculator.

Ensure which necessary documents are required for loan application.

Accurately provide all required information in the loan application form for prompt processing.

Essential documents that need to be provided to complete the process successfully are listed below:

Aadhaar Card, PAN Card, Voter ID, Passport, Driving License

Aadhaar Card, Passport, Utility bills, Ration Card, Driving License

Udyam Registration Certificate, Partnership Deed, MoA, AoA, Sales Deed, business license from govt. authority, Certificates, rent agreement, and property tax receipt

Bank statements, Income Tax Returns, Profit and Loss Account, Balance Sheet, GST Returns, if applicable

A good credit history is essential

The business should have a stable income from kacha pakka record

Any residential property, and any commercial property

mmnimum age 21, maximum 60 on loan maturity

Frequently Asked Questions